Separating your budget into fixed expenses, savings expenses, and variable costs will help you organize your bank accounts and manage your money properly. Basic Monthly Budget Food, 773, 12.2 Child Care, 1,300, 20.5 Health Care, 522, 8.2 Transportation, 556, 8.8 Miscellaneous, 787, 12.4.

#Monthly expenses list how to#

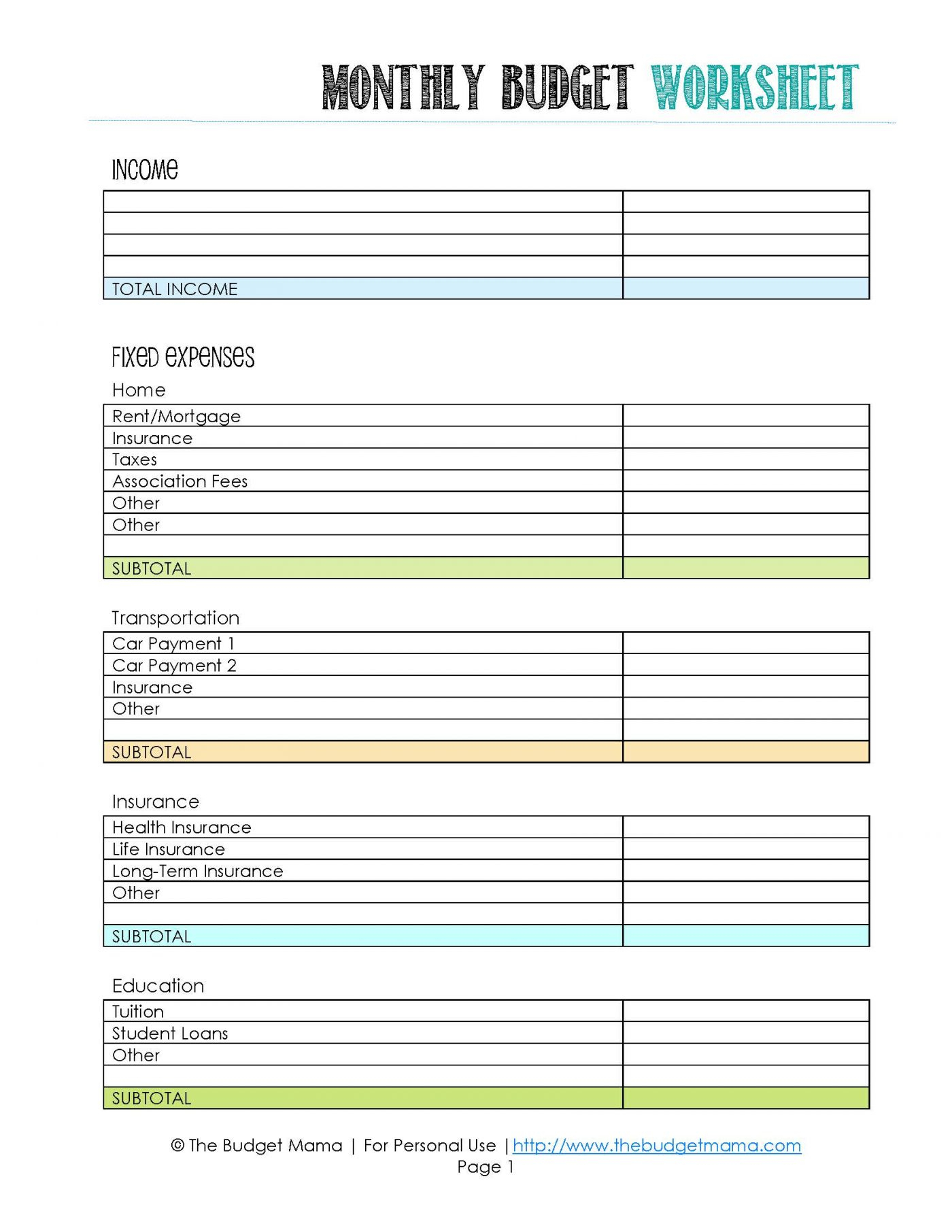

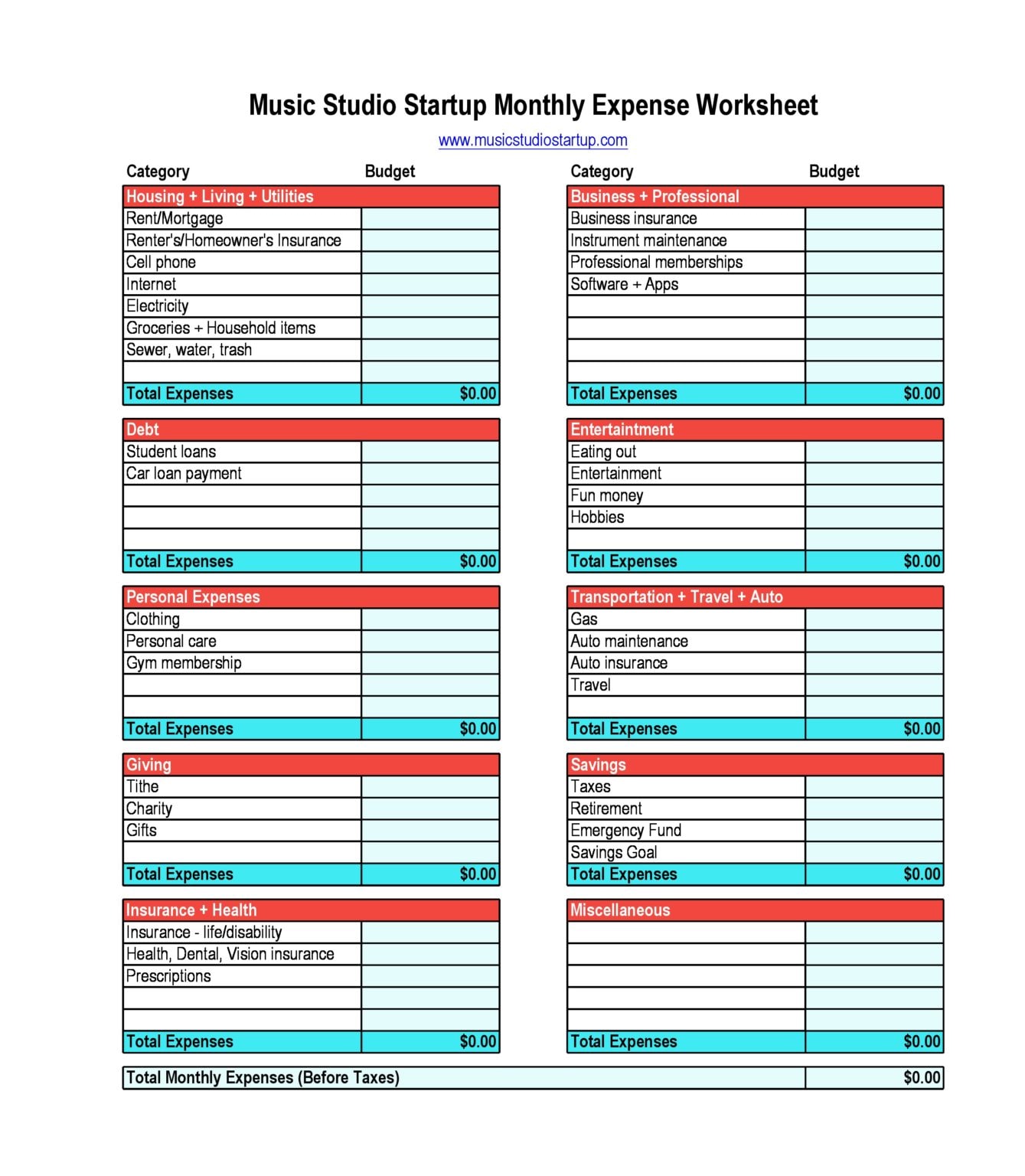

How Will Fixed, Savings and Variable Costs Help Me Learn How To Budget My Money Properly? Sometimes expenses will fit into more than one category and if that happens, you can choose where you feel the cost belongs in your budget.

If you find an extra expense in your budget and you’re not sure if you should put it under the fixed, savings, or variable costs, simply ask yourself these questions: It lets you know what "normal" expenses would be for your financial situation, and once you're done, it can review your budget and look for dozens of ways to help you improve it or save money.Įxtra Expenses – Are They Fixed, Savings, or Variable Costs? If you eat out three times a week with your family or friends, you could potentially save hundreds of dollars each month by eating at home or by simply moving these gatherings to someone’s house.As another way to help making budgeting simpler and more fun, we've created a personal budget template that guides you through the budgeting process. This category can include things like trips to the coffee shop, going to the movies, and dining out at restaurants with friends. Discretionary expenses: These are personal expenses where you have more control over what and how much to spend.For example, turning down the heater by a degree or two in the evening or using coupons for your purchases can help decrease these flexible costs.

#Monthly expenses list pdf#

You can lower these expenses by changing your habits. Monthly Digital Planner PDF for iPad (Dark Theme) Monthly Digital Planner PDF for iPad (White theme) EDITABLE.

To find patterns in your spending, try organizing your purchases in an expenses worksheet. While this includes your recurring living expenses, such as your rent or mortgage, car payment, and utilities, it also includes the more variable amounts you spend on haircuts, groceries, and clothes each month. Looking for charges you make regularly can help you determine your largest expenses. These documents, such as bills, mortgage statements, and account statements, can help you see exactly where your money is going.

If you take the process step-by-step, it can be surprisingly easy to find out how you’re spending your money. If more cash seems to be going out than coming in, a great way to get control is to set aside some time to calculate your expenses. Are you spending more than you earn You need to trim your. Between your monthly bills, daily necessities, and the little things you buy along the way, it can be difficult to know where all your money goes. Oh, and keep track of your monthly income, or how much money you are bringing home each month.

0 kommentar(er)

0 kommentar(er)